Renters Insurance in and around Miami

Welcome, home & apartment renters of Miami!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Miami Renters!

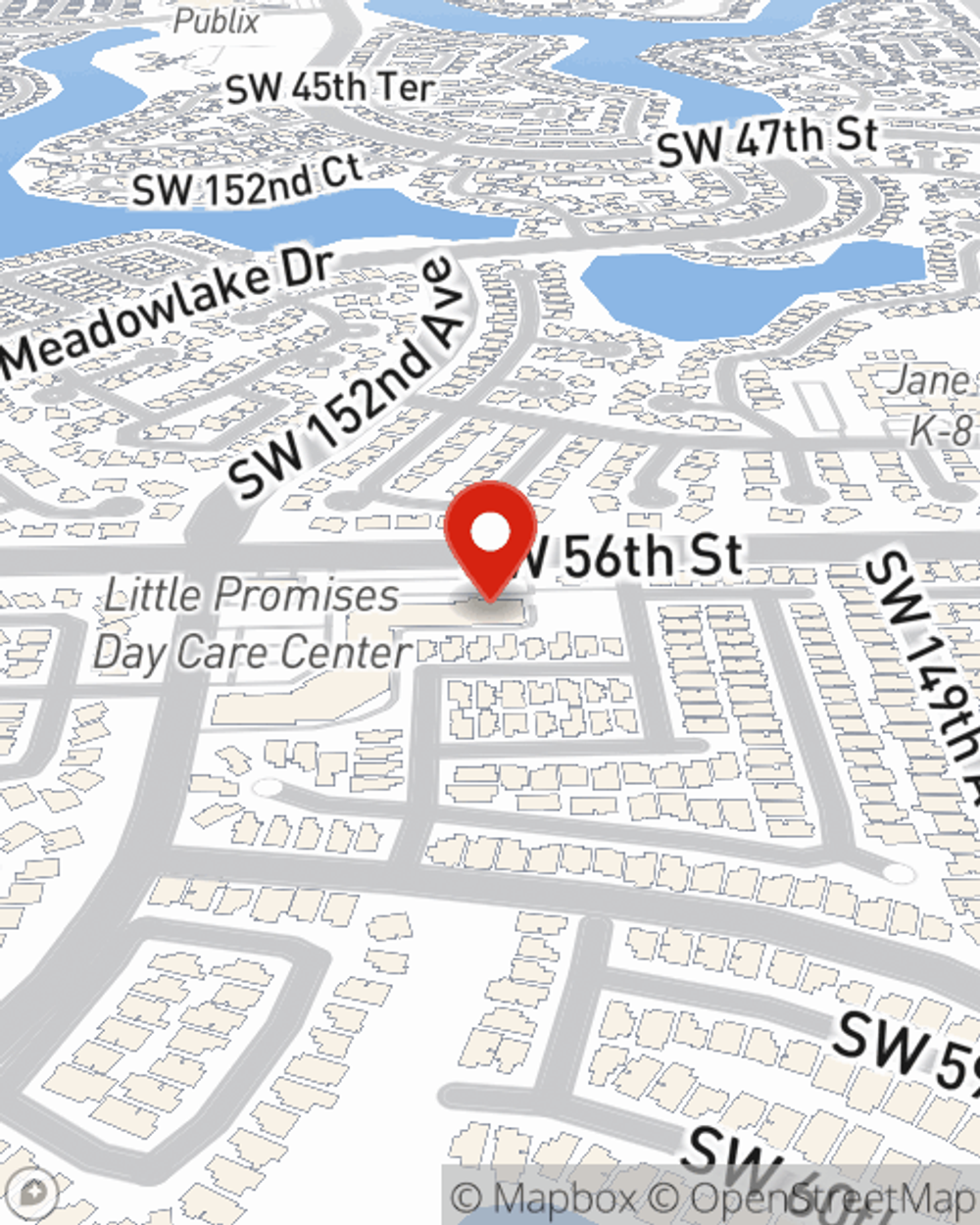

The place you call home is the cornerstone for everything you cherish. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented townhome or apartment, you should have renters insurance—even if your landlord doesn’t require it. It's coverage for the things you do own, like your couch and desk... even your security blanket. You'll get that with renters insurance from State Farm. Agent Peter Pinto can roll out the welcome mat with the dedication and wisdom to help you keep your belongings protected. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Welcome, home & apartment renters of Miami!

Coverage for what's yours, in your rented home

Why Renters In Miami Choose State Farm

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented apartment include a wide variety of things like your favorite blanket, exercise equipment, dining room set, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Peter Pinto has the dedication and experience needed to help you choose the right policy and help you keep your belongings protected.

Don’t let fears about protecting your personal belongings keep you up at night! Contact State Farm Agent Peter Pinto today, and explore how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Peter at (305) 386-7170 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Peter Pinto

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.